If you’re exploring investment opportunities in South America, Guyana real estate offers incredible potential. With its rich natural resources, growing economy, and strategic location, Guyana is quickly becoming a sought-after destination for property buyers and investors alike. From modern developments in Georgetown to serene plots near the countryside, there’s something for everyone in this emerging market.

As you dive into the Guyanese property landscape, you’ll discover a mix of residential, commercial, and agricultural options. Whether you’re searching for a vacation home, a rental property, or land for development, Guyana presents a unique blend of affordability and opportunity. Its evolving infrastructure and increasing foreign interest only add to its appeal.

Navigating this market requires understanding local trends, legal processes, and the best areas to invest in. By gaining insight into Guyana’s real estate scene, you can make informed decisions and take advantage of this promising market before it becomes saturated.

Understand Guyana Real Estate: Fastest Growing Emerging Market

Guyana’s real estate market is gaining significant attention as one of the fastest-growing emerging markets globally. Its economic expansion, driven by the thriving oil sector, creates robust opportunities for property investment.

Introduction to Guyana’s Real Estate Market

The rise in Guyana’s oil discoveries is transforming its real estate landscape. With over 11 billion barrels of confirmed oil reserves, the revenue has significantly boosted infrastructure and urban development. The demand for residential, commercial, and industrial properties has surged in coastal hubs like Georgetown and new oil-driven towns near the Essequibo coast.

Urban housing developments and luxury properties are witnessing heightened interest, especially from expatriates and international investors. Increased oil revenues contribute to public-private partnerships, funding large-scale projects like mixed-use developments and eco-tourism real estate.

Overview of Guyana’s Economic Boom

Guyana’s economy is growing faster than most nations, spurred by the oil industry. According to the IMF, Guyana’s GDP increased by 62% in 2022, making it the fastest-growing economy globally. This exceptional growth pumps capital into infrastructure projects and public services, directly impacting real estate demand.

The expansion in highways, ports, and utilities fuels opportunities for commercial investors. Hinterland regions with untapped resources are becoming attractive for agricultural land purchases. Key regions like Demerara-Mahaica benefit from this economic uplift, transforming them into viable investment hotspots.

Why Guyana is an Emerging Real Estate Market

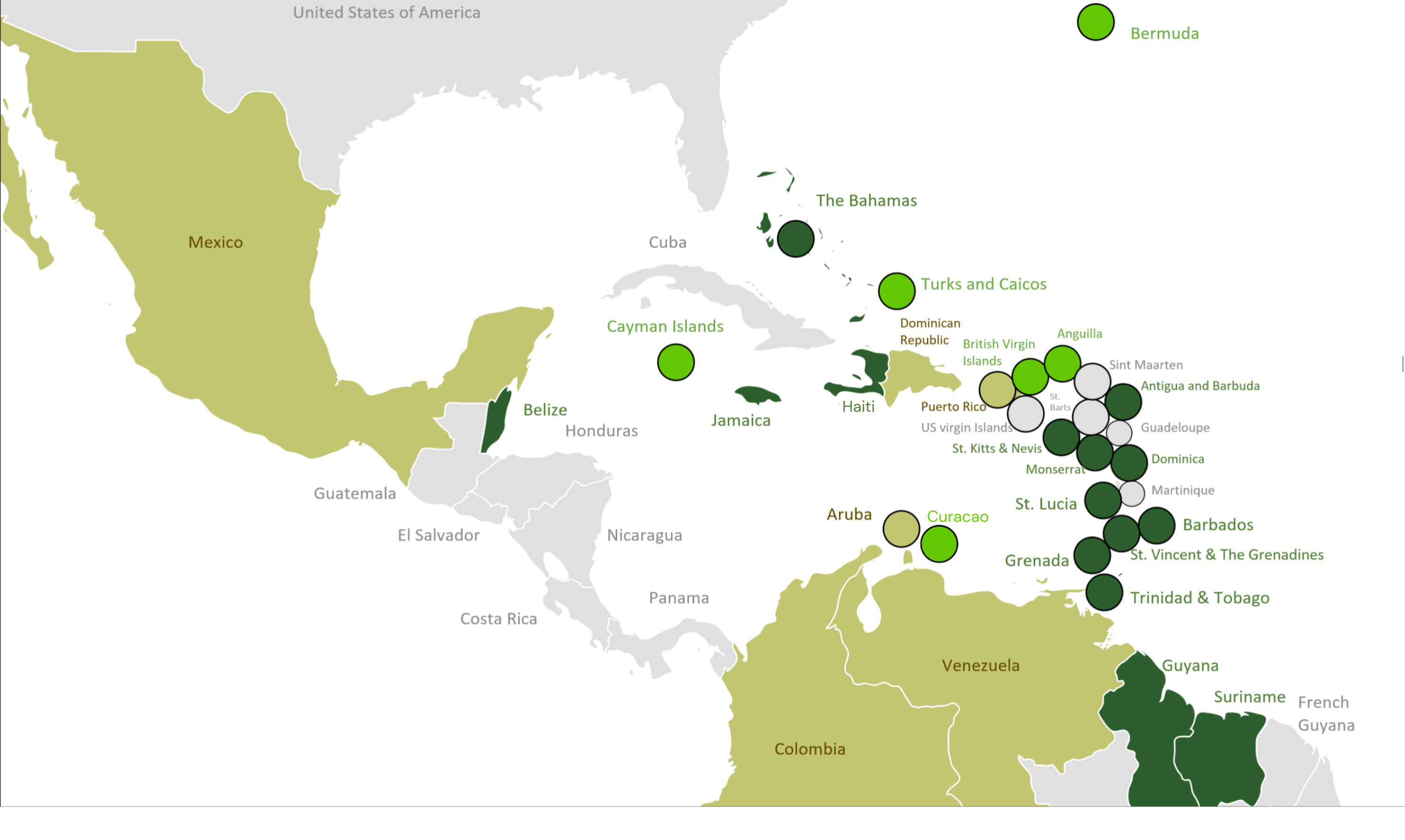

Guyana’s strategic location on South America’s northern coast positions it as a gateway for trade between Latin America and the Caribbean. The thriving oil economy attracts foreign investors interested in capitalizing on emerging real estate markets. Competitive property prices relative to other regional markets make Guyana property appealing.

Government incentives, such as tax exemptions for renewable energy projects and special economic zones, further enhance investment attractiveness. Tourism-linked developments, fueled by eco-tourism demand, bring additional growth prospects. Coastal and riverine properties, situated near major development areas, offer lucrative returns as infrastructure initiatives expand accessibility.

Economic Growth and Real Estate Expansion

Guyana’s economic transformation has propelled its real estate market into one of the fastest-growing globally. The surge in urbanization, commercial activity, and infrastructure investments ties closely to the country’s oil-driven prosperity.

Impact of the Oil Boom on GDP and Infrastructure

The discovery of over 11 billion barrels of oil has been pivotal for Guyana’s GDP, which expanded by 62% in 2022, the highest global growth rate. This oil boom translates into increased government revenue and foreign investments, boosting major infrastructure projects such as roads, bridges, and ports. These developments improve connectivity and access, directly benefiting Guyana property markets.

Key oil-producing regions like Georgetown have witnessed a surge in real estate activity. Coastal towns and areas near new oil fields are in high demand among expatriates and companies entering the market. The direct correlation between oil sector growth and infrastructure expansion supports emerging real estate markets across the country.

Growth in Residential, Commercial, and Industrial Properties

Rising economic activity has created a diversified real estate landscape in Guyana. Residential developments range from affordable housing projects to high-end gated communities, addressing the growing needs of locals, expatriates, and executives in the oil industry.

Commercial spaces, particularly office buildings and retail centers, are multiplying in urban hubs like Georgetown to meet business demands from oil firms and service providers. Industrial properties, including logistics facilities near ports and oil-related infrastructure, have also expanded, showcasing the market’s flexibility and growth potential.

This multi-segment growth positions Guyana as a competitive destination for real estate investors searching for emerging markets influenced by tangible economic drivers.

Infrastructure Development Supporting Real Estate Growth

Significant infrastructure upgrades underpin Guyana’s real estate expansion. The government’s strategic focus on building transportation systems, such as the Linden to Mabura road project and upgrades to Demerara Harbor Bridge, enhances connectivity, opening access to remote regions with untapped property potential.

The modernization of utilities and public services, driven by oil revenues, improves quality-of-life metrics and adds value to properties across Guyana. Developments like eco-friendly housing projects near major infrastructure also cater to the eco-tourism boom, blending sustainability with growth.

Infrastructure growth not only supports existing urban markets but also facilitates opportunities for new residential and commercial hubs to thrive in previously underdeveloped regions. This trend establishes Guyana as a high-potential real estate market linked to impactful economic progress.

Investment Opportunities in Guyana

Explore investment prospects in Guyana real estate, where economic growth, fueled by the oil boom, has created a thriving property market.

Hotspots in Georgetown and Coastal Areas

Georgetown, Guyana’s capital, serves as the primary real estate hotspot. Coastal neighborhoods and central districts like Queenstown and Bel Air Park feature high-demand properties, including luxury homes and commercial spaces. Proximity to government offices, international businesses, and major infrastructure projects adds significant value to these areas.

Coastal towns, particularly near emerging oil hubs, also attract investors. Locations like Bartica and New Amsterdam offer opportunities in residential and mixed-use properties as urbanization and development expand. Waterfront properties near the Essequibo and Demerara Rivers have become prime real estate, drawing interest for vacation homes and hospitality ventures. Rising property values in these areas position them as lucrative options within the Guyana property market.

High-Yield Sectors: Eco-Tourism and Hospitality

Eco-tourism and hospitality represent fast-growing real estate sectors. With Guyana’s pristine rainforests, unique wildlife, and UNESCO World Heritage sites, demand for eco-lodges and sustainable accommodations has increased. Properties catering to eco-conscious tourists offer consistent returns, driven by enhanced tourism infrastructure and promotion of sustainable travel.

Hospitality investments in oil-related regions offer even higher growth potential. Accommodations near oil production hubs and coastal cities like Georgetown attract expatriates, industry professionals, and business travelers. Luxury hotels, serviced apartments, and boutique guesthouses in these areas meet growing demand while yielding substantial profits.

Residential Rentals Driven by Expatriates and Oil Industry Workers

Residential rental demand has surged, driven by Guyana’s oil sector boom. Expatriate professionals, oil workers, and relocating families often seek high-end apartments and housing developments in Georgetown and its suburbs. Gated communities and furnished rentals are particularly appealing to this demographic.

Emerging real estate markets in Linden and Berbice also see growing rental activity. New infrastructure investments and regional development linked to Guyana oil operations attract workers in these areas. Long-term returns from rental properties are supported by a stable tenant base, making this sector a key focus for maximizing yields in Guyana’s dynamic real estate market.

Market Challenges in Guyana Real Estate

Investing in Guyana’s real estate market offers significant opportunities, but navigating its challenges requires careful planning. Key concerns include regulatory complexities, infrastructure limitations, and risk mitigation in this emerging market.

Regulatory Hurdles and Title Security Issues

Guyana’s real estate transactions often involve regulatory inefficiencies and unclear land ownership records. You might encounter outdated property registries and insufficient documentation, creating disputes over ownership rights. These issues are particularly prevalent in rural areas and older neighborhoods, impacting the valuation and saleability of properties.

The lack of centralized legal frameworks in some regions amplifies transaction delays and uncertainties. For example, acquiring Guyana property near high-demand oil-producing zones in Georgetown may require navigating lengthy legal checks to confirm title authenticity. Engaging experienced real estate attorneys ensures compliance with local laws and minimizes potential roadblocks.

Underdeveloped Infrastructure and Its Impact on Investments

Inadequate infrastructure, especially in rural and underdeveloped areas, affects property accessibility and desirability. Roads, bridges, and utilities in non-urban regions lag behind urban hubs like Georgetown or New Amsterdam. This limits the appeal of properties outside these cities, even amid growing demand driven by Guyana’s booming oil economy.

Infrastructure gaps increase the cost of developing properties, including waterfront estates or commercial spaces. For instance, installing utilities for properties near the Essequibo River often requires additional investment. Monitoring government infrastructure projects, such as new transportation networks, helps identify areas poised for future growth and improved real estate prospects.

Strategies for Mitigating Risks in Emerging Markets

Mitigating risks in Guyana’s emerging real estate markets demands proactive strategies. Diversify your investment portfolio by exploring various property types, like residential units for expatriates in Georgetown and agricultural lands in coastal zones. This minimizes exposure to market fluctuations tied to specific sectors, such as oil production booms.

Partnering with local experts, including real estate agents and legal advisors, strengthens your understanding of the market’s evolving dynamics. For better returns, target properties in areas benefiting from projects like government-backed infrastructure upgrades or eco-tourism initiatives. Comprehensive due diligence, particularly when investing in emerging real estate markets, ensures informed decisions and long-term success.

Conclusion

Guyana’s real estate market offers a unique blend of opportunity and growth, making it an attractive destination for savvy investors like you. With its booming economy, strategic location, and diverse property options, the potential for long-term returns is undeniable.

By staying informed about local trends, navigating regulatory challenges, and leveraging expert guidance, you can position yourself to capitalize on this emerging market. Whether you’re eyeing urban developments, eco-tourism ventures, or rental properties, Guyana’s evolving landscape presents endless possibilities for success.