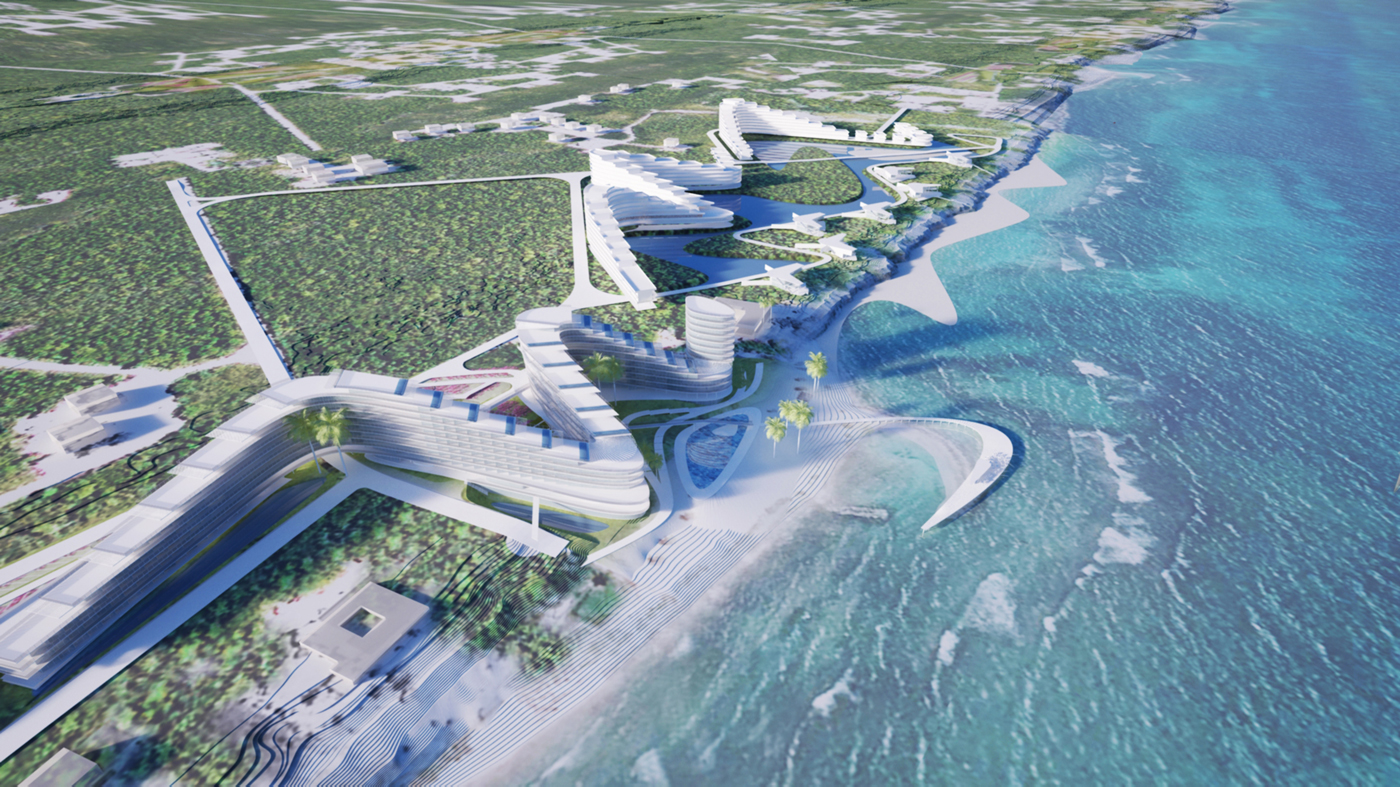

When you think of the Caribbean, it’s easy to picture turquoise waters and sandy beaches, but its rich history is just as captivating. Caribbean historic properties offer a glimpse into centuries of culture, colonial influence, and architectural marvels that have withstood the test of time. These landmarks tell stories of resilience, transformation, and heritage that shape the region’s unique identity.

Exploring these historic gems takes you beyond the typical tourist experience. From grand plantation estates to ancient forts overlooking the sea, each property holds a piece of the Caribbean’s past. You’ll uncover the blend of indigenous, African, and European influences that have left their mark on the islands.

Whether you’re a history enthusiast or simply curious about the Caribbean’s cultural roots, visiting these properties is a journey into the heart of the region’s legacy. They’re more than just buildings—they’re living connections to the stories that define the Caribbean.

Caribbean Real Estate: Investing in Historic Properties

The Caribbean offers unparalleled opportunities for investing in heritage real estate. Historic properties in key markets like Bridgetown, Barbados, and San Juan, Puerto Rico, combine cultural significance with modern investment potential.

Introduction to Historic Properties

Historic properties in the Caribbean range from colonial estates in Charlestown, Nevis, to forts in Kingston, Jamaica. These sites reflect centuries of European, African, and indigenous influences. English Harbour, Antigua, with its Georgian naval heritage, exemplifies the unique architecture and stories behind these properties.

Owning a piece of history carries prestige, but it also provides tangible benefits. In Bridgetown, properties offer proximity to UNESCO-listed sites, making them attractive for tourism ventures. Strategic locations like San Juan blend history with vibrant urban lifestyles, increasing their demand among buyers.

Definition and Appeal of Heritage Real Estate

Heritage real estate refers to properties honoring cultural significance, historical craftsmanship, and architectural legacy. The Caribbean markets this type of real estate through eclectic designs, historical relevance, and prime locations.

Investment appeal stems from combining authenticity with functionality. Restored properties, such as plantation houses in Nevis, serve as boutique hotels, attracting heritage tourism. Similarly, adaptive reuse initiatives in Bridgetown convert historic structures into commercial assets, aligning with market trends. These elements make heritage real estate a valuable investment.

Importance of Preservation in the Caribbean

Preservation safeguards the Caribbean’s cultural and architectural identity while enhancing property value. Efforts in markets like Kingston and English Harbour ensure the longevity of historic sites, aligning them with investment trends.

Governments and organizations promote sustainable restoration to support tourism and economic growth. In San Juan, tax incentives encourage preservation and upgrades, attracting investors. By maintaining authenticity, you contribute to the region’s heritage and benefit from growing demand for preserved historic properties.

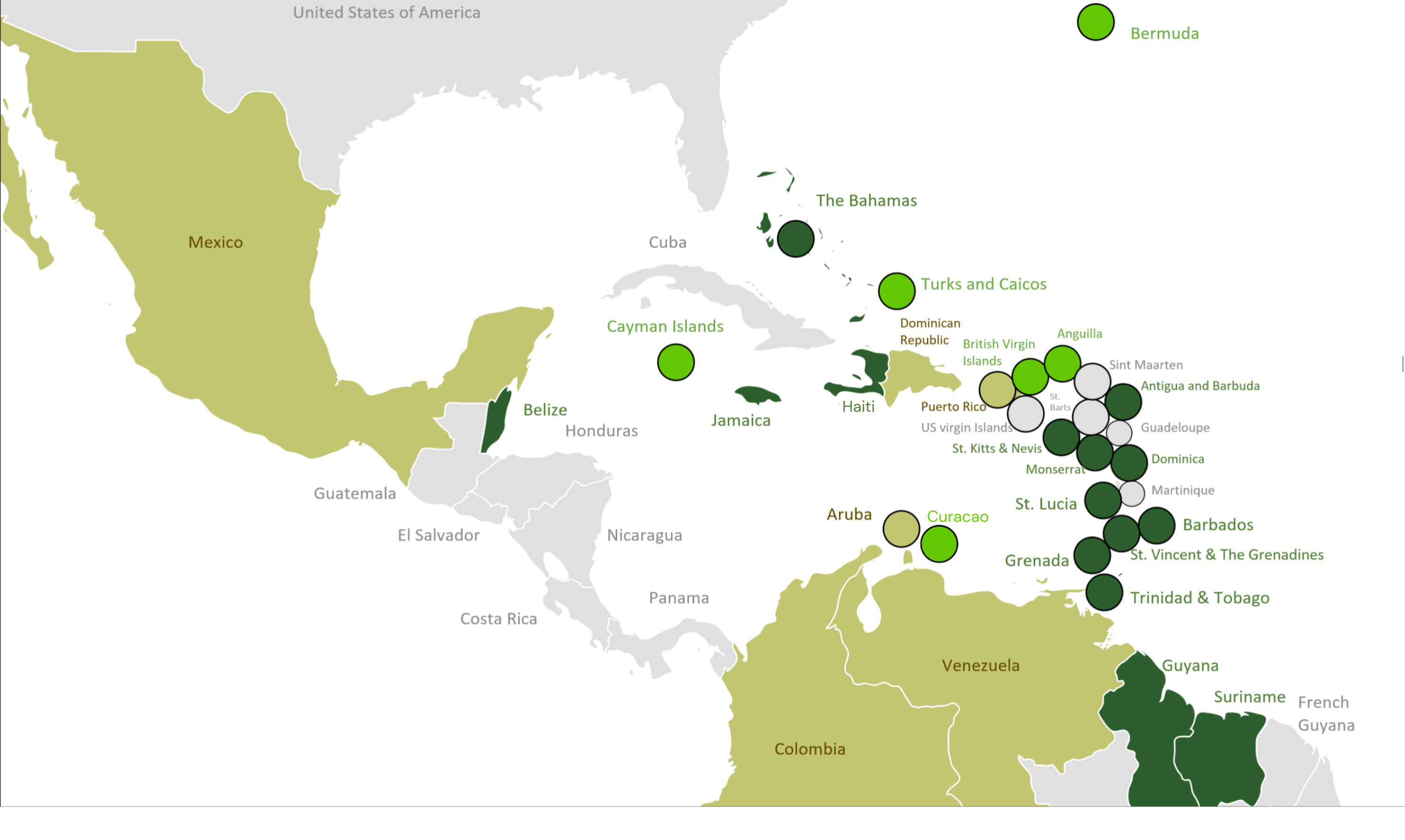

Key Investment Markets

Caribbean historic properties represent unique opportunities in heritage real estate, combining cultural value with significant investment potential. Exploring market trends in key locations enhances your ability to make informed decisions while prioritizing preservation efforts.

San Juan, Puerto Rico: Historic Districts with High Demand

San Juan’s historic districts, such as Old San Juan, attract consistent interest from investors. Properties here typically include colonial-era buildings and plazas that showcase Spanish architectural influences. Due to its vibrant tourism, Old San Juan offers opportunities for boutique hotels, restaurants, and retail spaces. Market trends show strong rental demand driven by the influx of visitors. Preservation remains a priority, with government incentives available for restorations that maintain the city’s cultural identity. Investing in restored properties here aligns with both financial returns and heritage conservation.

Bridgetown, Barbados: Colonial Charm and Modern Potential

Bridgetown combines colonial-era charm with evolving commercial opportunities. Historic estates and buildings reflect British influences, creating a foundation for restoration projects in the city’s UNESCO-designated areas. Market trends indicate increased focus on commercial use, particularly for luxury accommodations and office spaces. With heritage real estate central to Bridgetown’s character, efforts in preservation protect historical integrity while boosting asset value. The city’s robust tourism and business climate present solid paths for investors seeking long-term growth.

Kingston, Jamaica: Blending History with Urban Growth

Kingston offers a unique mix of historical landmarks and urban redevelopment. Heritage properties, such as Georgian-style estates, contribute to the dynamic appeal for cultural tourism and commercial adaptation. Recent market trends highlight the growing relevance of mixed-use developments in historic districts. Restoration projects in Kingston often benefit from tax incentives designed to enhance preservation while attracting investors. This interplay between historic value and modernization positions Kingston as a compelling market for heritage real estate investment.

English Harbour, Antigua: Maritime Heritage and Luxury Appeal

English Harbour centers around a rich maritime history, anchored by landmarks like Nelson’s Dockyard, a UNESCO World Heritage site. Large estates and waterfront properties attract high-end investors seeking luxury developments, such as boutique resorts or private villas. This market emphasizes preservation, blending restoration with the harbor’s historic character. Market trends favor high-value investments, supported by Antigua’s focus on sustainable tourism. The appeal of English Harbour lies in its combination of historical significance and luxury opportunities.

Charlestown, Nevis: Cultural Significance and Investment Opportunities

Charlestown is recognized for its rich cultural history and well-preserved Georgian-style buildings, which offer diverse investment potential. Properties here often serve as heritage hotels, museums, and cultural centers, benefiting from steady tourism. Current market trends show gradual growth in demand for restored properties aligning with preservation priorities. Government incentives encourage sustainable restoration, ensuring long-term value for both investors and the community. Charlestown’s distinct cultural identity anchors its status as a key destination for heritage real estate ventures.

Investment Potential

Historic properties in the Caribbean hold significant investment potential, combining architectural heritage with commercial viability. Key markets like Bridgetown, Barbados, and English Harbour, Antigua, attract investors seeking opportunities in heritage real estate.

High-Value Returns from Restored Properties

Restored heritage real estate generates substantial value by merging historical appeal with modern functionality. Properties like Georgian-style buildings in Charlestown, Nevis, or colonial estates in Bridgetown, Barbados, appeal to high-net-worth individuals and developers. Successfully restored sites often command premium prices in the real estate market, particularly in high-demand tourist regions.

Mixed-use restoration enhances returns, with buildings converted into luxury accommodations, boutique hotels, or commercial spaces. Markets such as San Juan, Puerto Rico, show a proven track record of strong rental yields driven by tourism and business travelers. Preservation strategies supported by tax incentives and grants boost value while safeguarding cultural integrity.

Tourism-Driven Demand for Heritage Real Estate

Tourism sustains demand for heritage properties across the Caribbean. Visitors increasingly seek authentic cultural experiences, favoring destinations like Old San Juan, Puerto Rico, with its preserved colonial architecture. Similarly, English Harbour, Antigua, attracts high-end tourists and investors drawn to its maritime heritage.

Market trends emphasize heritage preservation as a cornerstone of tourism appeal. Luxury developments, particularly in Bridgetown and Kingston, convert historical landmarks into profitable assets catering to global travelers. Investment potential rises when restoration aligns with sustainable tourism, ensuring that the unique character of each property enhances its marketability and long-term earning capacity.

Market Trends

Caribbean historic properties are gaining traction in heritage real estate due to their unique blend of cultural significance and economic potential. Interest in restoring iconic architecture aligns with rising demand for authentic tourism experiences and investment opportunities.

Increasing Interest in Preserving Architectural History

Preservation efforts are shaping market trends, as investors see heritage properties as valuable assets. Markets like Bridgetown, Barbados, and San Juan, Puerto Rico, where tourism thrives, showcase restoration projects that balance authenticity with modern use. Restoration of colonial estates and forts attracts buyers who value cultural identity alongside the properties’ real estate appeal.

Government incentives, such as tax benefits and grants, further support preservation initiatives, driving awareness and action in sustainable restoration. In English Harbour, Antigua, and Charlestown, Nevis, historic landmarks benefit from these programs, increasing their desirability. This focus on architectural conservation creates opportunities for investors seeking properties tied to Caribbean history while meeting tourism demand.

Balancing Commercial Use and Preservation

A balance between preservation and commercial use strengthens the market value of heritage real estate. Restored properties in tourist hubs like Kingston, Jamaica, and Bridgetown, Barbados, successfully integrate functionality into their rich history. Mixed-use developments, including boutique hotels and luxury accommodations, cater to high-end travelers and urban investors, offering profitable returns.

Preservation guidelines ensure historical integrity while allowing adaptive reuse. Investors adapt these sites to maintain cultural relevance without sacrificing economic viability. In high-demand markets such as San Juan, Puerto Rico, this ensures sustainability and sustained growth for historic real estate, blending tradition with modernity for optimal investment outcomes.

Preservation Importance

Historic properties in the Caribbean form the backbone of cultural and architectural identity, promoting tourism, economic growth, and community pride. Preservation ensures these landmarks remain relevant and valuable for both heritage and investment purposes.

Role of Historic Properties in Community Identity

Historic properties connect communities with their cultural roots, reflecting their unique heritage and shared history. In towns like Charlestown, Nevis, and English Harbour, Antigua, Georgian architecture and maritime landmarks highlight local traditions and reinforce collective identity. These sites offer residents a sense of pride, while tourists gain authentic cultural experiences.

Commercial use of preserved historic properties, such as boutique hotels in Bridgetown, Barbados, and mixed-use spaces in Kingston, Jamaica, fosters economic engagement. Restoration projects enhance urban environments, balancing modern functionality with cultural preservation. These projects maintain historical character, which defines community aesthetics and attracts tourists.

By anchoring local traditions in preserved architecture, historic properties contribute to resilience in evolving markets. Their importance extends beyond cultural preservation, strengthening local economies reliant on heritage tourism.

Partnerships with Preservation Societies and Government Programs

Collaborations with preservation societies and governments bolster restoration efforts for heritage real estate. In San Juan, Puerto Rico, tax incentives promote the restoration of colonial districts like Old San Juan, enabling developers to undertake sustainable preservation projects. This aligns cultural significance with investment potential.

Government programs often provide grants or tax benefits to alleviate restoration costs. For example, Caribbean nations invest in conserving landmarks while encouraging private-sector participation through market incentives. Partnerships with global heritage organizations further ensure adherence to restoration standards, protecting architectural authenticity.

These combined efforts make preservation viable for investors while safeguarding cultural identities. Initiatives in markets like Bridgetown and Kingston emphasize mixed-use development, demonstrating how partnerships enhance both community identity and economic growth.

Conclusion

Caribbean historic properties offer a rare combination of cultural depth and economic opportunity. Whether you’re drawn to their architectural beauty, rich heritage, or investment potential, these landmarks provide unmatched value. By preserving these treasures, you contribute to safeguarding the region’s identity while unlocking sustainable growth.

Exploring or investing in these properties allows you to be part of a meaningful journey that celebrates the Caribbean’s vibrant past and promising future. The blend of preservation and innovation ensures these historic gems remain relevant, impactful, and rewarding for generations to come.